Right now, you may be more concerned about your 2019 tax bill than you are about your 2020 tax situation. That’s understandable because your 2019 individual tax return is due to be filed in less than three months.

Right now, you may be more concerned about your 2019 tax bill than you are about your 2020 tax situation. That’s understandable because your 2019 individual tax return is due to be filed in less than three months.

Many taxpayers make charitable gifts — because they’re generous and they want to save money on their federal tax bills. But with the tax law changes that went into effect a couple years ago and the many rules that apply to charitable deductions, you may no longer get a tax break for your generosity.

If you’re getting ready to file your 2019 tax return, and your tax bill is higher than you’d like, there may still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until the Wednesday, April 15, 2020, filing date and benefit from the resulting tax savings on your 2019 return.

If you save for retirement with an IRA or other plan, you’ll be interested to know that Congress recently passed a law that makes significant modifications to these accounts. The SECURE Act, which was signed into law on December 20, 2019, made these four changes.

The number of people engaged in the “gig” or sharing economy has grown in recent years. And there are tax consequences for the people who perform these jobs, such as providing car rides, renting spare rooms, delivering food and walking dogs. Generally, if you receive income from these gigs, it’s taxable. That’s true even if the income comes from a side job and if you don’t receive a 1099-MISC or 1099-K form reporting the money you made. You may need to make quarterly estimated tax payments because your income isn’t subject to withholding. Some or all of your business expenses may be deductible on your tax return, subject to the normal tax limitations and rules. Contact us to learn more.

You may wonder if you can get a tax break for medical and dental expenses, as well as prescription drugs. Here’s what it takes and how you might be able to benefit by moving certain expenses into 2019.

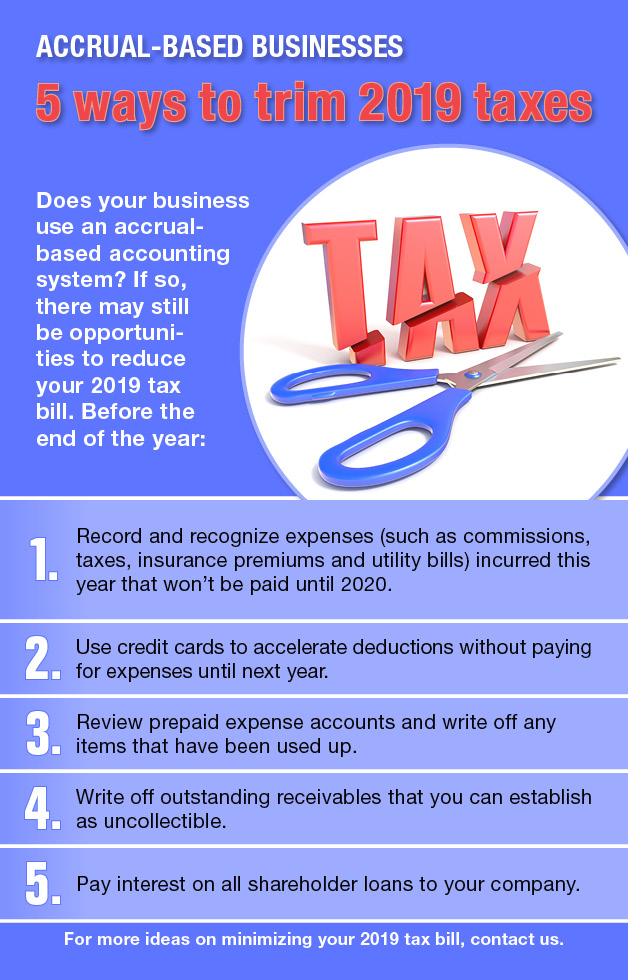

There may still be opportunities to reduce your company’s 2019 tax bill.

ALERT!!!! You could get an unexpected tax bill or a refund for 2017 or 2018 from Minnesota Revenue! Minnesota Legislature’s 2019 Special Session partially conformed Minnesota tax law to 2017 federal tax law. Retroactively! The Minnesota legislature has a hard…

The IRS has launched a special campaign encouraging taxpayers to perform a “paycheck checkup” to ensure the right amount of tax is being withheld from their paychecks for 2019. This is particularly important given changes implemented by the Tax Cuts…

A Rumor is Floating: Did our Whippersnapper Legislators in St Paul Decide to Conform to Federal Tax Law? In 2017, Congress and President Trump passed the Tax Cuts and Jobs Act of 2017 (TCJA). It dramatically changed the definition of…

The Research and development (R&D) tax credit is a permanent fixture in the tax code. Some estimates put the amount of credit claimed at over $13 billion annually. This credit was established by congress to encourage business innovation, process improvement…

It’s not just businesses that can deduct vehicle-related expenses. Individuals also can deduct them in certain circumstances. Unfortunately, the Tax Cuts and Jobs Act (TCJA) might reduce your deduction compared to what you claimed on your 2017 return. For 2017,…

The Tax Cuts and Jobs Act made major changes to the tax code including a new deduction for business to take a 20% deduction on Qualified Business Income. For many operating businesses it is pretty straight forward as to whether…

What’s all the hype about this new tax law? The Tax Cuts and Jobs Act of 2017 encompassed many federal tax law changes that will affect your 2018 tax filings. A highlight of some changes include: Higher standard deductions…

Carlson Advisors, LLP Announces Name Change and Move of Minneapolis Location Effective July 1, 2018, we are changing our name to LB Carlson, LLP. The name LB Carlson was selected in honor of the firm’s founder Lawrence ‘Lary’ B. Carlson….