Employer Resource Guide: FAQ – Adjustments to FMLA and Paid Sick Leave in Response to COVID-19

The COVID-19 virus has made fast, drastic changes to how we live and work. State-mandated business closures are creating challenges and generating many questions on how to preserve business continuity during this period. On March 18, 2020, President Trump signed the Families First Coronavirus Response Act (FFCRA), which takes effect on April 2. The bill expanded paid sick leave and unemployment benefits, impacting employees and employers, among other provisions.

SBA Providing Disaster Assistance Loans to Qualified Small Businesses

Qualified small businesses are now eligible for up to $2 million in Economic Injury Disaster Loans from the Small Business Administration (SBA) after President Trump called for an additional $50 billion in funding to the SBA’s lending program from Congress in response to COVID-19. While the SBA waits for the $50 billion to be approved, they can deliver an Economic Injury Disaster Loan declaration in response to the Coronavirus Preparedness and Response Supplemental Appropriations Act recently signed by the president.

Look closely at your company’s concentration risks

The word “concentration” is usually associated with a strong ability to pay attention. Business owners are urged to concentrate when attempting to resolve the many challenges facing them. But the word has an alternate meaning in a business context as well — and a distinctly negative one at that.

5 ways to strengthen your business for the new year

The end of one year and the beginning of the next is a great opportunity for reflection and planning. You have 12 months to look back on and another 12 ahead to look forward to. Here are five ways to strengthen your business for the new year by doing a little of both:

What’s the right device policy for your company?

Device policies pertaining to smartphones and other technology tools are evolving. Loose “bring your own device” (BYOD) policies are giving way to stricter “choose your own device” (CYOD) or “corporate-owned, personally enabled” (COPE) policies. A CYOD policy lets employees buy a device for combined personal/work use from a company-approved list. Generally, the employee owns the device while the business owns the SIM card and any proprietary data. Under a COPE policy, the employer buys and owns the device, which is intended for business use. The cost is higher, but it comes with greater control. We can help you analyze the potential costs of a device policy and make the right choice.

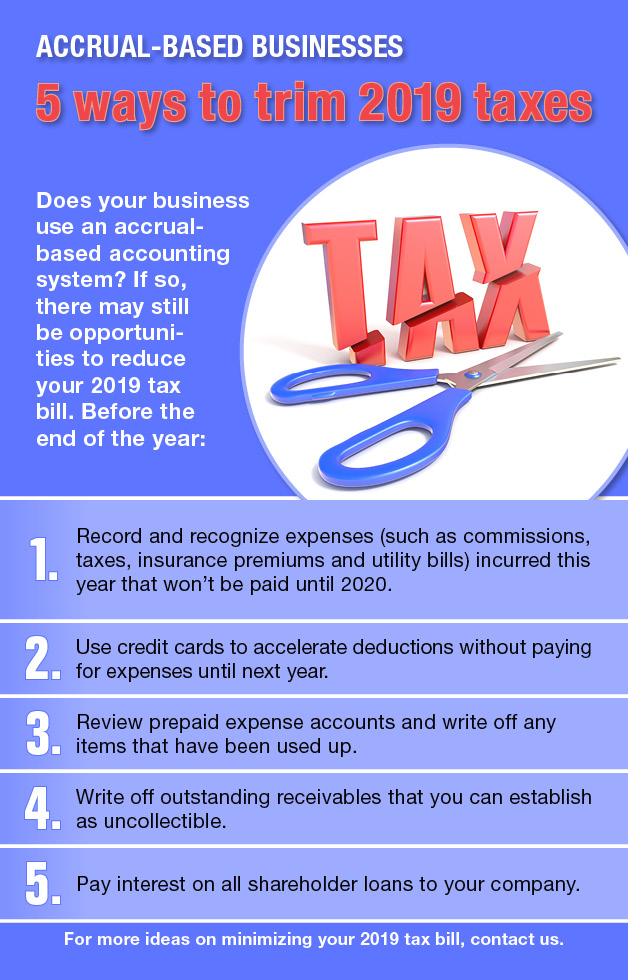

5 Ways to Trim Your 2019 Tax Bill

There may still be opportunities to reduce your company’s 2019 tax bill.

3 key traits of every successful salesperson

The best salespeople are closers, who seal the deals and pull in the revenue that drives a company’s bottom line. And they all have these three things in common.

63rd Annual PIM (Printing Industry Midwest) Golf Outing

LB Carlson was a proud beverage and hole sponsor at the Minnesota 63rd Annual PIM (Printing Industry Midwest) Golf Outing on August 8th, 2019 held at Bunker Hills Golf Club, Coon Rapids, MN.

LB Carlson Facilitates and Advises The John Roberts Company in their Asset Acquisition of HM Graphics, Inc.

LB Carlson was involved throughout the entire process including; initial valuation and assessment of investment opportunity, Letter of Intent negotiations, preparation of financial projections, due diligence, financing assistance, review of definitive agreements, structuring, general consultation and advisory to John Roberts…

Financial Statements Tell Your Business’s Story, Inside and Out

Ask many entrepreneurs and small business owners to show you their financial statements and they’ll likely open a laptop and show you their bookkeeping software. Although tracking financial transactions is critical, spreadsheets aren’t financial statements. In short, financial statements are…

Research and Development Tax Credits – An Untapped Opportunity in the Graphic Arts Industry

The Research and development (R&D) tax credit is a permanent fixture in the tax code. Some estimates put the amount of credit claimed at over $13 billion annually. This credit was established by congress to encourage business innovation, process improvement…

- Accounting, Assurance & Attest, Graphic Arts, Latest News, Management Consulting, Manufacturing, Medtech, Non-profit, Real Estate, Taxes

- posted by LB Carlson

- June 23, 2018

Carlson Advisors, LLP Announces Name Change and Move of Minneapolis Location

Carlson Advisors, LLP Announces Name Change and Move of Minneapolis Location Effective July 1, 2018, we are changing our name to LB Carlson, LLP. The name LB Carlson was selected in honor of the firm’s founder Lawrence ‘Lary’ B. Carlson….

An EAP Can Keep Your Top Players on The Floor

A good basketball team is at its best when its top players are on the floor. Similarly, a company is the most productive, efficient and innovative when its best employees are in the right positions, doing great work. Unfortunately, it’s…

Envision your advisory board before you form it

Many companies reach a point in their development where they could benefit from an advisory board. It’s all too easy in today’s complex business world to get caught up in an “echo chamber” of ideas and perspectives that only originate…