Financial Relief for Families Tax Credit – What to Expect with Your Check

The distribution of economic impact payments is expected to begin in the next three weeks and be available throughout the rest of 2020. With so much news circulating, it can be difficult to keep tabs on the latest updates. We also recognize it can be challenging to separate the legitimate updates from speculation. Below we have put together a summary of what we know so far about the economic impact payments.

CARES Act Overview: The Impact on Taxpayers and Businesses

The President signed the latest COVID-19 relief bill on March 27: The Coronavirus Aid, Relief, and Economic Security (CARES) Act. The bill brings with it several elements of relief for businesses, employees and families, in an effort to maintain livelihoods throughout the crisis and after. The expected cost of the bill is nearly $2 trillion and includes nearly $500 billion for in economic distress relief for businesses, states and municipalities.

IRS’ Employer COVID-19-Related Credits

The IRS has announced that employers required to provide emergency paid sick leave and emergency paid family and medical leave under the Families First Coronavirus Response Act (the Act) can begin taking advantage of two new refundable payroll tax credits. Equivalent credits are available to self-employed individuals based on similar circumstances.

Employer Resource Guide: FAQ – Adjustments to FMLA and Paid Sick Leave in Response to COVID-19

The COVID-19 virus has made fast, drastic changes to how we live and work. State-mandated business closures are creating challenges and generating many questions on how to preserve business continuity during this period. On March 18, 2020, President Trump signed the Families First Coronavirus Response Act (FFCRA), which takes effect on April 2. The bill expanded paid sick leave and unemployment benefits, impacting employees and employers, among other provisions.

SBA Providing Disaster Assistance Loans to Qualified Small Businesses

Qualified small businesses are now eligible for up to $2 million in Economic Injury Disaster Loans from the Small Business Administration (SBA) after President Trump called for an additional $50 billion in funding to the SBA’s lending program from Congress in response to COVID-19. While the SBA waits for the $50 billion to be approved, they can deliver an Economic Injury Disaster Loan declaration in response to the Coronavirus Preparedness and Response Supplemental Appropriations Act recently signed by the president.

Look closely at your company’s concentration risks

The word “concentration” is usually associated with a strong ability to pay attention. Business owners are urged to concentrate when attempting to resolve the many challenges facing them. But the word has an alternate meaning in a business context as well — and a distinctly negative one at that.

5 ways to strengthen your business for the new year

The end of one year and the beginning of the next is a great opportunity for reflection and planning. You have 12 months to look back on and another 12 ahead to look forward to. Here are five ways to strengthen your business for the new year by doing a little of both:

What’s the right device policy for your company?

Device policies pertaining to smartphones and other technology tools are evolving. Loose “bring your own device” (BYOD) policies are giving way to stricter “choose your own device” (CYOD) or “corporate-owned, personally enabled” (COPE) policies. A CYOD policy lets employees buy a device for combined personal/work use from a company-approved list. Generally, the employee owns the device while the business owns the SIM card and any proprietary data. Under a COPE policy, the employer buys and owns the device, which is intended for business use. The cost is higher, but it comes with greater control. We can help you analyze the potential costs of a device policy and make the right choice.

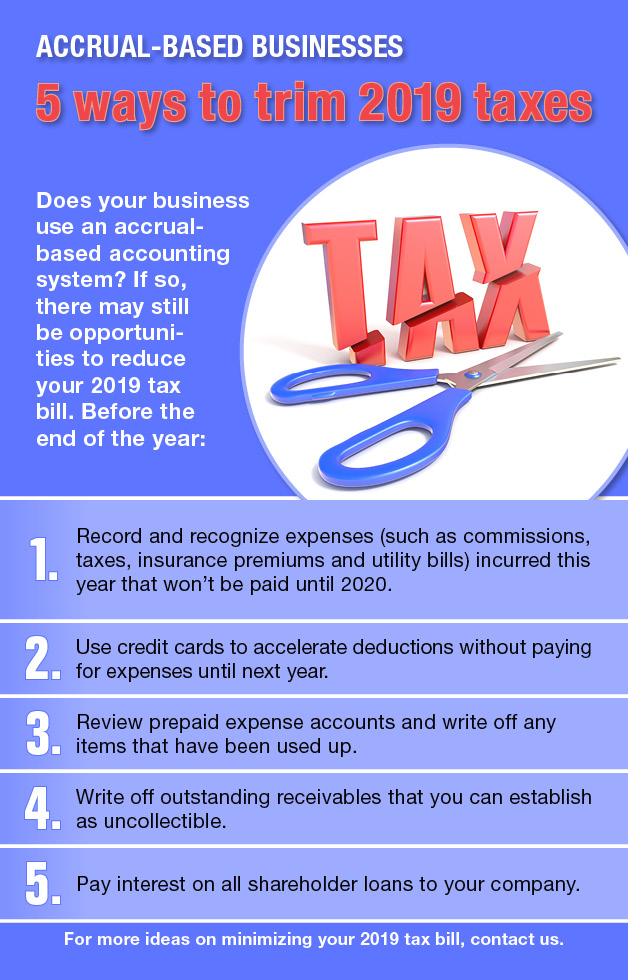

5 Ways to Trim Your 2019 Tax Bill

There may still be opportunities to reduce your company’s 2019 tax bill.

3 key traits of every successful salesperson

The best salespeople are closers, who seal the deals and pull in the revenue that drives a company’s bottom line. And they all have these three things in common.

Financial Statements Tell Your Business’s Story, Inside and Out

Ask many entrepreneurs and small business owners to show you their financial statements and they’ll likely open a laptop and show you their bookkeeping software. Although tracking financial transactions is critical, spreadsheets aren’t financial statements. In short, financial statements are…

IRS Provides Some Clarification for Rental Real Estate and QBI Deduction

The Tax Cuts and Jobs Act made major changes to the tax code including a new deduction for business to take a 20% deduction on Qualified Business Income. For many operating businesses it is pretty straight forward as to whether…

Minnesota MHA Conference 2018

We attended the Minnesota Multi Housing Association’s Convention Products Show on October 9, and this year’s theme was “Game On!”. Attendees stopped by our booth and had fun playing a bags game in order to win a drink ticket. We…

- Accounting, Assurance & Attest, Graphic Arts, Latest News, Management Consulting, Manufacturing, Medtech, Non-profit, Real Estate, Taxes

- posted by LB Carlson

- June 23, 2018

Carlson Advisors, LLP Announces Name Change and Move of Minneapolis Location

Carlson Advisors, LLP Announces Name Change and Move of Minneapolis Location Effective July 1, 2018, we are changing our name to LB Carlson, LLP. The name LB Carlson was selected in honor of the firm’s founder Lawrence ‘Lary’ B. Carlson….

Own a vacation home? Adjusting rental vs. personal use might save taxes

Now that we’ve hit midsummer, if you own a vacation home that you both rent out and use personally, it’s a good time to review the potential tax consequences: If you rent it out for less than 15 days: You…